Philip Morris Says Its New Year's Resolution is to Give Up Cigarettes

The cigarette company says that they finally want to help kick the harmful habit for their customers.

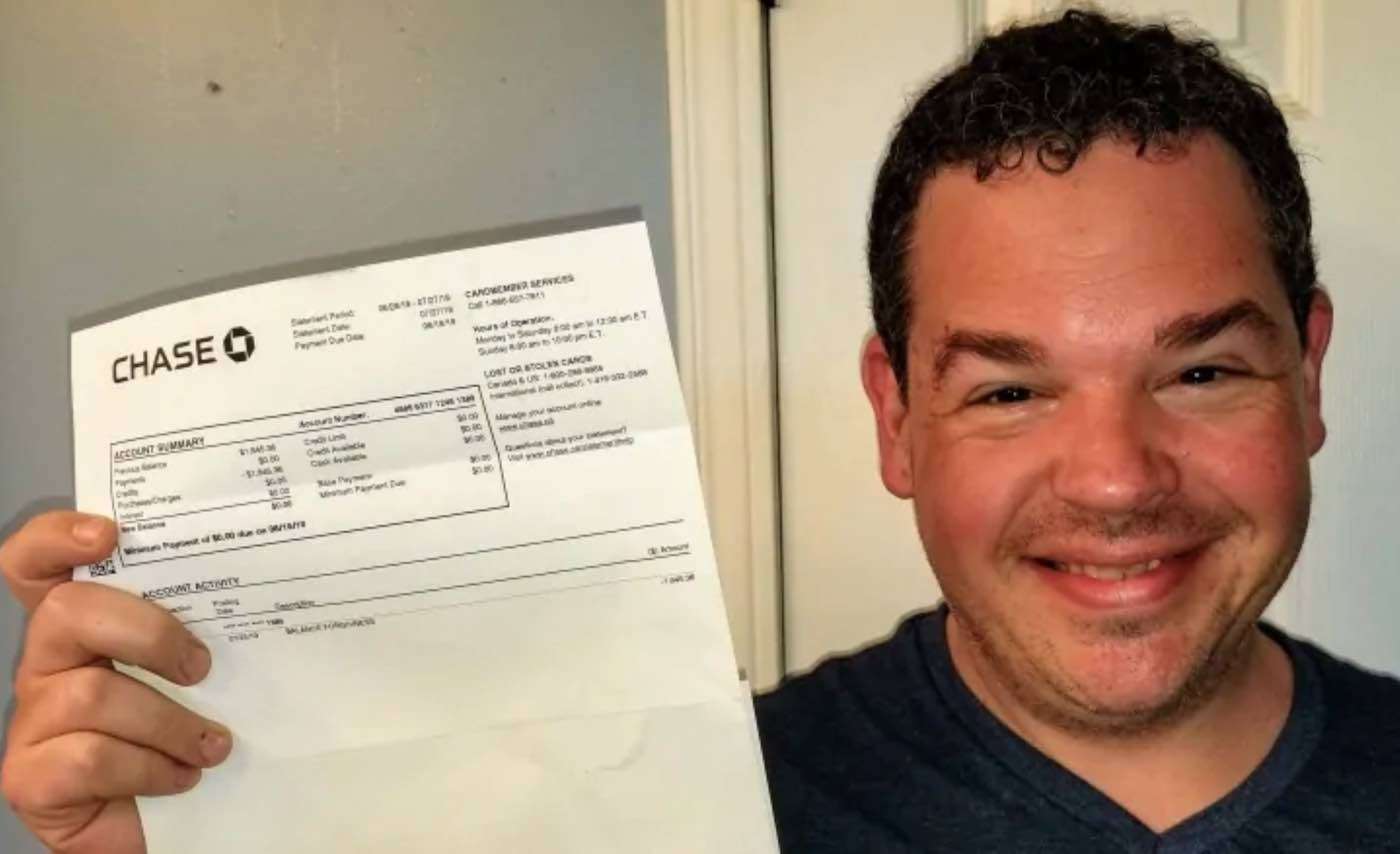

It's not often that banks are praised for their compassion, but Canadian credit card holders are rejoicing over their bank's recent decision to forgive all outstanding debt on two of their old Visa programs.

After spending a little over a decade in the Canadian credit card market, US-based Chase Bank opted to retire their Amazon.ca Rewards Visa and their Marriott Rewards Premier Visa in March 2018.

As of last week, there were still Canadian cardholders who were making payments on their outstanding card debt-but Chase, rather than selling the debt to third party-collectors, sent letters to all of their Canadian customers this week explaining that their debt had been forgiven.

"Ultimately, we felt it was a better decision for all parties, particularly our customers," Chase spokesperson Maria Martinez said in an email to CBC.

Despite how financial analysts have been confused by the bank's decision to forgive the debt, Canadian customers are still in disbelief over their good fortune.

"Its crazy," one customer told the Canadian news outlet. "This stuff doesn't happen with credit cards. Credit cards are horror stories."

Though Chase declined to say how much debt had collectively been wiped out by their decision, their former Amazon credit card boasted a 19.9% interest rate-and some Canadian cardholders told CBC that they had been forgiven for as much as $6,000 in debt.

"I was sort of over the moon all last night, with a smile on my face," another consumer told CBC. "I couldn't believe it."

Bank On Positivity By Sharing The Good News To Social Media - Photo by Paul Adamson

Be the first to comment