Her Student Debt Was Paid in Full After A Bank Heard Her Family Story

After a former college student shared her heartbreaking family story on CNN, her $54,000 student loan was completely forgiven, thanks to a JPMorgan Chase program.

After a former college student shared her heartbreaking family story on CNN, her $54,000 student loan was completely forgiven, thanks to a JPMorgan Chase program.

Under new, more generous financial aid guidelines, Stanford University will offer free tuition to talented students whose parents earn annual incomes below $125,000.

Aetna became the latest corporation to announce a voluntary minimum wage hike. 5700 workers received checks last week reflecting the new salary of $16/hour.

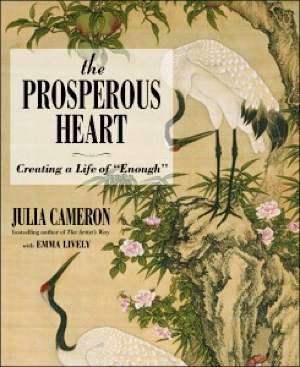

Julia Cameron, best known for her landmark book on unblocking creativity, The Artist's Way, has a new book that answers the question, 'How can I live the creative life but still pay my mortgage?'

The graffiti artist who took Facebook stock instead of cash for painting the walls of the social network's first headquarters made a smart bet. The shares owned by the artist, David Choe, are expected to be worth upward of $200 million when Facebook stock trades publicly later this year.

Throughout all the turmoil for the US economy in 2011, U.S. stocks have been surprisingly resilient. "We believe this is a testament to a combination of U.S. economic resilience, U.S. corporate financial strength and pricing power, and severe relative undervaluation of equities," said Thomas Lee, chief U.S. equity strategist with JPMorgan. Lee has compiled eight reasons why he will remain optimistic in 2012

In the biggest victory for consumers since Netflix's recent mea culpa, Bank of America said today that it was abandoning its plan to charge customers a $5 fee every time they use their debit cards. The bank relented, but only after other large banks had indicated that they would not impose similar fees.

Saving energy has evolved from a moral calling to a financial imperative for businesses that have broadened the concept of energy efficiency to one of sustainability.

Two good news stories in the financial sector caught our eye this week: Hefty stock purchases by company officers and directors is growing evidence that insiders believe their companies have the worst of the recession behind them and their stocks should rise this year, analysts said last week.

Apple CEO Tim Cook is turning down a payout worth approximately $75 million. Cook is requesting that he not receive new stock dividends, after receiving just shy of $400 million in compensation last year. One writer chalks it up to classiness.

The Dow Jones industrials index climbed to its highest level in nearly 5 years on Friday, after a surprise drop in the unemployment rate pointed to continued improvement in the labor market. The S&P 500 rose for a fifth straight day and was also on course to close near a 5-year high.

The controversial government bailout of the huge global insurer, AIG, during the worst days of the financial crisis in 2008, will yield billions of profit for the US treasury and taxpayer. The treasury department announced Tuesday that it will sell 234 million shares in American International Group (AIG), bringing the estimated profit on the original AIG TARP assistance to $22.7 billion.

70-year old Thessaloniki mayor Yannis Boutaris stands apart from the political mainstream, pulling off reforms that have so far evaded the national government in its three-year-old debt crisis. In contrast to the rest of Greece, this sea-front city of one million is shrinking debt, cutting business taxes to help firms and paying city employees and contractors on time.

Barclays boss Antony Jenkins has notified the bank's 140,000 employees of a new code of conduct. Even bonuses for 2012 will be assessed against the new Purpose and Values criteria.

By big city standards, Peter Breiter, 41, is an unusual banker. He left a bigger bank, where it was all sell, sell, sell, to settle in the tiny southern German village of Gammesfeld and write transaction slips by hand for its 500 inhabitants.

The Justice Department announced today that Bank of America will pay a record $16.65 billion fine to settle allegations that it knowingly sold toxic mortgages to investors. $7 billion of it will go to consumers faced with financial hardship.

Home prices surged during the first quarter at their fastest pace in nearly seven years, the latest sign of a sustained economic recovery. Consumer confidence also helped push stocks to a new high on Tuesday.

Increased demand boosted global manufacturing activity last month as U.S. factories expanded at their fastest pace in 2-1/2 years and Chinese output suggested improvement in the world's second largest economy. The 17-country euro zone's manufacturing sector also showed improvement in November, as did Britain's.

In America these days, if you are watching too much news, you're not getting the truth about the economy as much as political messaging and strategy. The truth is that the U.S. still has the strongest economy on the planet. America's performance should be measured against the current competition, not against the records it set in the 1990s or 2000s.

Very poor women in Peru are improving the lives of their families, thanks to business smarts, determination and a small business micro loan from Finca Peru, the family-run social enterprise that helps educate its 16,000 local micro-borrowers in savvy business growth.

Recent Stories

A Heartfelt Reminder to Appreciate the Ones We Love

Cherish the Woman Who Stands by You

Breaking Generational Cycles of Pain

Living by Your Own Values, Not Others' Approval

When Life Brings Rain, It’s Okay to Rest

Before You Judge Someone's Life, Take a Moment to Walk in Their Shoes.

A Friend Who Spreads Gossip is Not a True Friend at All

The Value of Human Connection Over Digital Convenience

The Quiet Kind of Love

One Day, Your Mom Won’t Call You Anymore

I’ve reached a point in my life...

Happiness is a mindset, a conscious choice we make every day